Should You Invest in Akiya (empty house)? An Overview of the Advantages and Disadvantages

The number of akiya is said to be increasing every year, and with such low prices and so many available government-backed renovation subsidies, more people are choosing to buy them. However, there are certain challenges that are important to consider when investing in akiya. For instance, you are bound to incur significant costs addressing structural issues such as leaks or termite damage after the purchase. If you’re quick to buy without carefully considering the additional costs and renovations required, it could lead to substantial losses. In this article, we will explain the current situation surrounding akiya, how to purchase them, the advantages and disadvantages of buying, and what to watch out for during the purchasing process.

The Current Situation of Akiya as a Social Issue

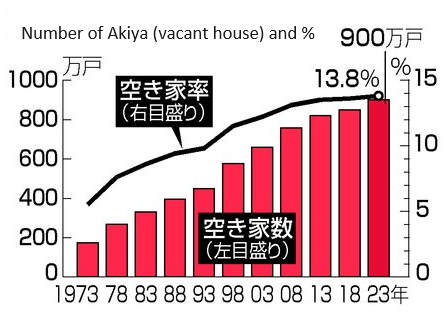

According to a survey conducted by the Statistics Bureau of the Ministry of Internal Affairs and Communications in 2018, there are 8.46 million akiya, with a vacancy rate of 13.6%, marking a record high. In the Kanto region, areas such as Setagaya, Suginami, and Ota in Tokyo, as well as Yokohama, are witnessing an increase in akiya, as are major urban areas in Kansai and Chubu, such as Kyoto, Kobe, and Nagoya. Many of these properties are aging and on the verge of collapse, leading to significant social issues such as impacts on the surrounding area and security problems.

The government is addressing the akiya issue by enforcing the “Special Measures Law for the Promotion of Measures against Akiya.” Alongside local government-operated “Akiya Banks,” the Japanese government has begun partnering with private companies to develop a nationwide version of the akiya bank. Despite these efforts, the issue remains unresolved.

What is the Special Measures Law for Akiya?

If you are interested in purchasing akiya, it is important to be aware of the Special Measures Law. This law allows for investigating the status of akiya properties. If a house poses a risk of collapse, poses health hazards, or is poorly managed in a way that affects the surrounding landscape, the national or local government can designate it as a “specific akiya” and take action by providing advice, guidance, recommendations, or orders.

If a house is designated as a specific akiya, it will no longer be eligible for tax benefits associated with property ownership, leading to increased taxes and necessitating measures such as demolition or renovation. If measures are neglected despite being designated, improvement orders can be issued, and failure to comply can result in fines of up to 500,000 yen. Ultimately, after a timeline and estimates are presented, forced demolition may occur through administrative enforcement, with costs billed to the property owner. This legislation requires current owners of akiya to respond promptly by either demolishing or selling their properties.

What is an Akiya Bank?

An “akiya bank” is a system operated by local governments that connects those looking to sell akiya properties with individuals interested in buying or renting them. You can apply through the website created by the local government’s akiya bank, and various subsidies are available depending on how you plan to utilize the property. Until now, the national government had largely left the oversight of akiya to local authorities, but with the continuing increase in akiya, they decided to begin collaborating with private companies to develop a nationwide akiya bank starting in April 2018.

Currently, the government is implementing various measures to address the akiya issue. The law encourages owners to dispose of their vacant properties, and utilizing systems like an “akiya bank” makes it easier for owners to manage their properties, creating a more favorable environment for those considering purchasing akiya. This suggests that the market for akiya may become a “buyers’ market” in the future.

Advantages of Akiya

Given the current situation of akiya, what advantages and disadvantages are there when considering using them as residences? First, let’s discuss the benefits and advantages of purchasing akiya.

1. Cost is Low

The biggest advantage of buying akiya is the low price. Many akiya are older, and the owners often want to dispose of them, leading to some properties being sold for only several hundred thousand yen.

2. You Can Renovate to Your Liking

If you can buy at a low price, you can allocate more funds for renovations, allowing you to create a living space tailored to your preferences without having to purchase a new building.

3. Subsidies from the Government and Local Authorities

If you meet the conditions set by the government or local authorities, you can utilize subsidies for renovations or remodels by using an akiya bank. For example, in Hyogo Prefecture, there are support programs for utilizing akiya in rural and urban areas, providing grants of up to 3 million yen for housing renovation costs. When selecting an akiya, be sure to check what kind of support is offered by the local authorities in the area you are considering.

4. Good Locations Available

Some older akiya may be located in desirable areas simply because they have been around for a longer time compared to newer properties. One benefit is being able to purchase a property in a good location for less than the market value simply due to its age. However, not all akiya are in good locations, so be sure to verify before making a purchase.

Disadvantages of Akiya

Now, let’s discuss the disadvantages of akiya.

1. Difficulties Due to Malfunctions and Aging

The low price of akiya comes with the drawback of their older age or condition. Due to aging, there may be issues such as broken water pipes or termite damage which can lead to various malfunctions once you begin living there. If you’re concerned, have a professional inspect the property to objectively assess its condition, and consider having a home inspection before finalizing the purchase.

2. Renovation and Repair Costs

Areas such as kitchens, bathrooms, and gas water heaters may be prone to failure due to the age of the original equipment, necessitating renovations, repairs, or replacements. When purchasing, you should negotiate the price, taking into account how much these repairs will cost.

3. Difficulty Finding Properties That Meet Your Criteria

Many akiya are often left unattended by their owners and are not actively listed for sale. Additionally, because akiya are cheap, some real estate agents may not actively handle such listings. As a result, there are fewer akiya circulating in the real estate market, making it more challenging to find properties that meet your criteria.

Should You Buy Akiya?

While akiya are appealing because of their extremely low costs, there may be unexpectedly high fees for renovations and repairs after purchase. It’s essential to conduct thorough investigations of the property and land before purchasing, and if you’re buying for investment reasons, prepare a financial plan and conduct adequate research on the location.

In Japan, significant differences in future real estate values exist by area, as indicated by the notion of “three polarizations” in the real estate market. You should avoid purchasing solely based on the appealing price and instead make a decision after thorough investigation.