Tri-polarization of Real Estate

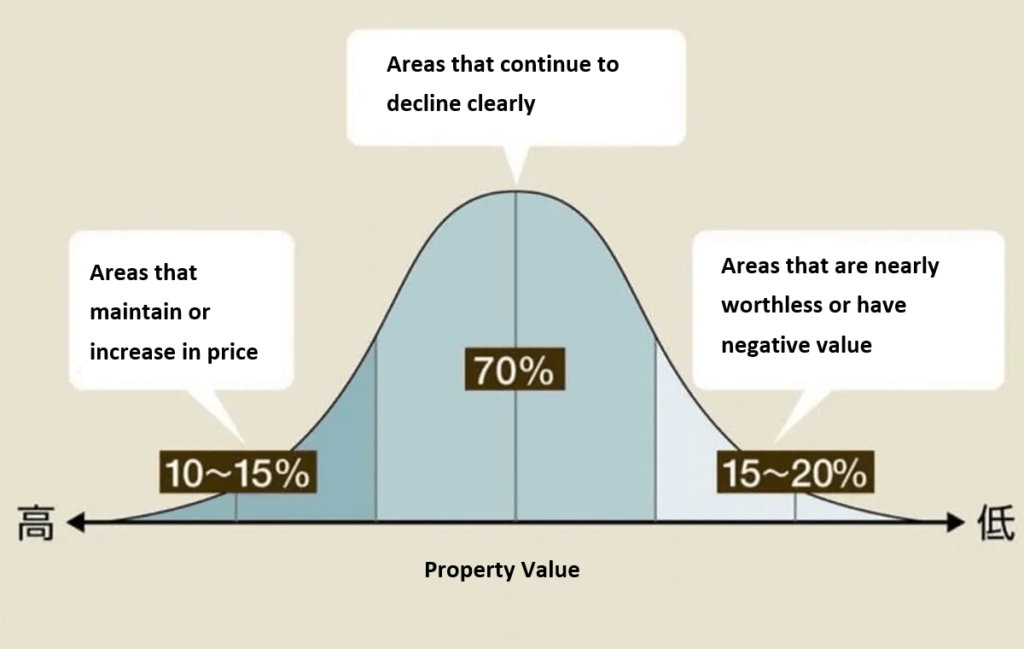

Japan’s real estate market is experiencing polarization. During the bubble economy of the 1980s, real estate prices across Japan were rising, but currently, the values are diverging into three categories:

- Properties whose prices have been maintained or are continuing to rise

- Properties whose prices are gradually declining

- Properties that are becoming nearly worthless

Following the monetary easing after the change of government in 2012, the surge in real estate prices has further advanced the polarization in the market. As prices for some properties in urban centers continue to soar, the disparities seem to be widening.

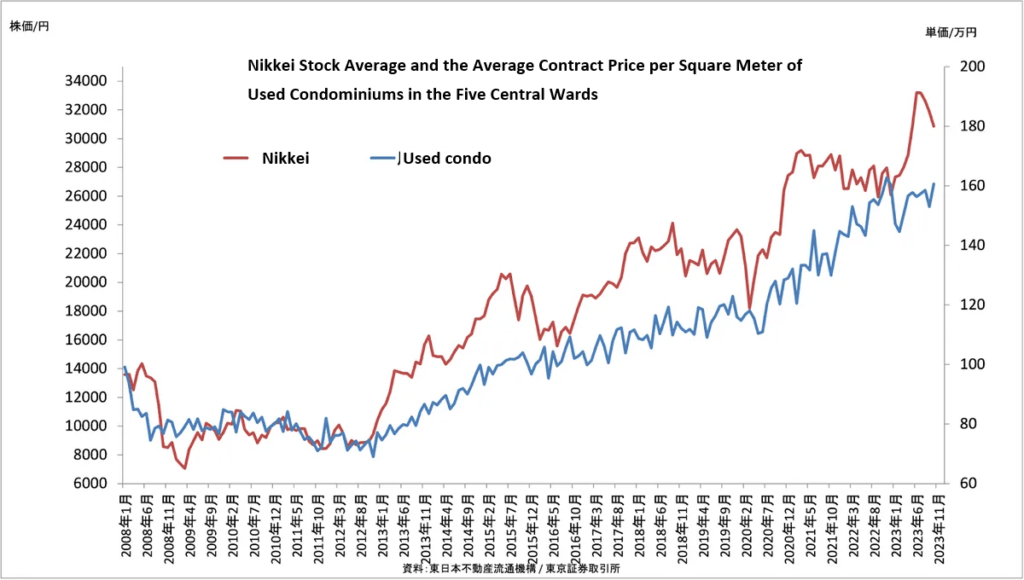

Since the beginning of 2024, the Nikkei Stock Average has been rising, and the contract price per square meter for used condominiums in the five central wards of Tokyo has also increased in line with stock prices. However, the rise linked to stock prices is seen only in a portion of condominium prices in the five central wards and near suburban stations, around 10-15%. It is said that nearly 90% of real estate continues to decline gradually or has fallen significantly.

You might imagine that the “top 15%” refers to prime locations in the city center, but this is not always the case. There are also suburbs and regional areas that fit this category. Therefore, determining the location is crucial.

In large metropolitan areas such as the five central wards of Tokyo, popularity does not decline, while other areas are selected based on specific criteria. Specifically, key factors include “access to the city center,” “distance from the nearest station,” and “surrounding environment (such as schools, hospitals, and supermarkets)”. Prices will decrease in areas that do not meet these conditions.

To prepare for a real estate bubble and market polarization, it is important to assess whether your property is within the top 10-15% of properties that are predicted to not lose their value. The most important condition to be aware of when assessing real estate value is whether or not the property is in a favorable location. If you plan to purchase, you should choose properties in areas that are not experiencing a decline in population, such as city centers or properties near stations. Properties that do not meet these criteria should be sold promptly for the most lucrative outcome.

It is estimated that the depreciation of the yen will lead to a significant influx of foreign money into the Japanese real estate market, but the impact is thought to be localized. Both foreign and domestic investors primarily target urban properties. The areas most affected by the yen’s depreciation will be major metropolitan regions such as Tokyo, Osaka, Nagoya, Fukuoka, Sendai, and Sapporo.

Some regions in rural areas are already experiencing depopulation, and many local cities are planning to develop compact cities with limited residential areas. While there are reports that new condominium prices have surpassed those during the bubble period, the supply area for new condominiums has been almost exclusively urban. In the case of used homes, price increases are also limited to metropolitan areas, areas close to stations, and convenient suburban regions. The potential for real estate prices to rise due to the yen’s depreciation is also localized to urban areas.

I believe no other asset is as attractive in so many myriad ways as Japanese real estate. Even if the yen strengthens, or the global financial system changes, the relative value of real estate remains unchanged. In other developed countries, even major cities are facing office vacancy rates that have yet to recover, with some areas experiencing rates of 20% or 30%, while Japan has already recovered to single-digit figures. Real estate prices have risen considerably so far, but they still have room to grow due to being relatively undervalued compared to other countries. Although Japan’s real estate distribution system is still lagging behind that of other developed countries, it is gradually improving.

Prices for properties with good conditions, such as those within a 30-minute commute to central Tokyo, have soared, making it difficult for households with an annual income of 10 million yen or less to obtain loans. In such cases, one can only look for properties that fit their budget by lowering their search conditions, such as being a little farther from the city center, or a 15-minute walk from the station. As real estate prices rise, the structure of real estate disparity becomes more pronounced. If a property is in an area where prices are less likely to fall, it should not be difficult to find a buyer when it comes time to sell. However, in unpopular areas, it is likely to be difficult to find a buyer.

Additionally, with the increase in dual-income households, some people want to choose locations that allow for a balance between work and raising children. The intersection of these factors will likely be reflected in future real estate prices. With the acceleration of population decline and the aging population, as well as the widening income gap, there may be a possibility of a certain stratification in regions based on real estate choices.